Buyers Stamp Duty BSD Additional Buyers Stamp Duty ABSD Sellers Stamp Duty SSD. Transfer Documents for Properties.

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

Malaysias Economy Expands 89 in the Second Quarter Fastest Pace in a Year.

. For starters state governments have increased stamp duties and material holding costs for foreign buyers banks have tightened lending to foreign buyers and China has imposed tighter capital controls on its citizens. Stamp duty was increased from 3 to 4 on properties worth above MYR 1 million USD 238578. The income is deemed as a business sources if maintenance services or support services are comprehensively and actively provided in relation to the real property.

Lee will deliver. Stamp duty is a tax on a property transaction that is charged by each state and territory the amounts can and do vary. Stamp duty exemption for first-time home owners Malaysia 13 Jul 2022.

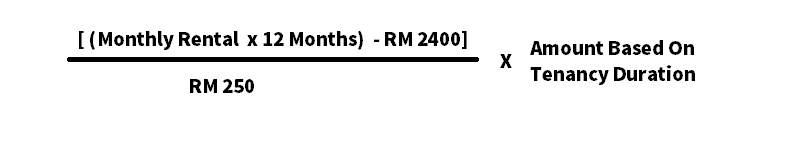

According to Amit Modi Director ABA Corp A Joint Development Agreement JDA is beneficial for both the owner as well as the developer. The tax collected by Central Board of Indirect Taxes and Customs. Therefore when calculating the stamp duty fee you need to deduct RM2400 from the annual rental amount to determine the taxable rental.

Stamp duty is payable under Section 3 of the Indian Stamp Act 1899. Calculate the stamp duty you may have to pay on your property using our tool. Competent consideration for the landlord.

3 Things To Look Out For In The. Do you have to pay stamp duty on rental agreements. Stamp duty exemption for loan agreements for purchase of home between RM300000 and RM25 million effective for sales and purchase agreements signed from 1 June 2020 to 31 May 2021.

Exchange of aid between Malaysia and other countries. Malaysia Real Estate Market is poised to grow at a CAGR of 45 by 2027. Mini Excavator 5 ton IHI-50 RM 48 000.

Happy Buying and Selling. In February 2020 as part of Indias. The First day of each calendar month of which rental shall be paid to the owner not exceeding the seventh day of each calendar month.

Due date for payment of monthly rent. Commercial Vehicle Boats. You need to pay a stamp duty when you buy a property and also when you go in for a rental agreement.

The first RM2400 of your annual rental income is entitled for stamp duty exemption. Deposit utiliti Ringgit Malaysia. The stamp duty rate ranges from 2 to 12 of the purchase price depending upon the value of the property bought the purchase date and whether you are a multiple home owner.

Defence Ministrys Housing Blueprint 30. The savings on stamp duty and RPGT alone run into the millions those savings will eventually be transformed into dividends for investors like us. Key Players in Malaysia Real Estate Market are Hartamas Real Estate Malaysia Sdn Bhd Bandar Utama City Sdn.

The stamp duty rate will depend on factors such as the value of the property if it is your primary residence and your residency status. 500- whichever is lower. What is stamp duty.

Stamp duty is 1 of the total rent plus deposit paid annually or Rs. Stamp duty is the governments charge levied on different property transactions. Stamp Duty Land Tax SDLT is a tax paid by the buyer of a UK residential property when the purchase price exceeds 125000.

In Malaysia income derived from letting of real properties is taxable under paragraph 4a business income or 4d Rental income of the Income Tax Act 1967. Real property gains tax exemption for disposal of up to three properties from 1 June 2020 to 31 December 2021. KL rental housing a bad choice for the urban poor.

When goods are exported outside India the tax is known as export custom duty. Search title only Show only URGENT. Urwah Saari.

When goods are imported from outside the tax known as import custom duty. Malaysia 15 Jul 2022. Fast-paced development of the property as working capital is majorly required for meeting the construction needs.

There are three types of duties payable on the sale purchase acquisition or disposal of properties in Singapore. Custom Duty is an indirect tax levied on import or export of goods in and out of country. Partial avoidance of stamp duty.

Malaysias taxman will be hard-pressed to keeping track on tax payments by all these investors hence you may notice that REITs charge a withholding tax on their dividends. Deposit utiliti dalam perkataan 9. Stamp Duty is calculated on the actual rent or market rent whichever is higher.

Procurement methods using privatisation will be considered says PM. The significant dip in foreign investment can be attributed to a number of factors. UK Home Rental Costs Set for More Sharp Increases RICS Says.

She also said in the statement she was referring to Buyers Stamp Duty an additional upfront tax on non-permanent resident buyers imposed by the government in 2012. The agreement should be printed on a Stamp paper of minimum value of Rs100 or 200-. So if you need to be on a safer side you can make the agreement on a Stamp paper of the appropriate value as prescribed by the government.

Monthly rental to credit to landlords bank account no. The government also introduced an additional 5 in real. SPA Stamp Duty Malaysia And Legal Fees For Property Purchase.

SEARCH NOW SAVE SEARCH. Find almost anything for sale in Malaysia on Mudahmy Malaysias largest marketplace.

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

Thanks For The Contactless Rental Stamp Duty Tenancy Agreement Runner Service Facebook

Tenancy Agreement Lhdn Stamping 2021

Drafting And Stamping Tenancy Agreement

Tenancy Agreement Stamp Duty Calculator Malaysia

Tenancy Agreement In Malaysia The Ultimate Guide Speedhome Guide

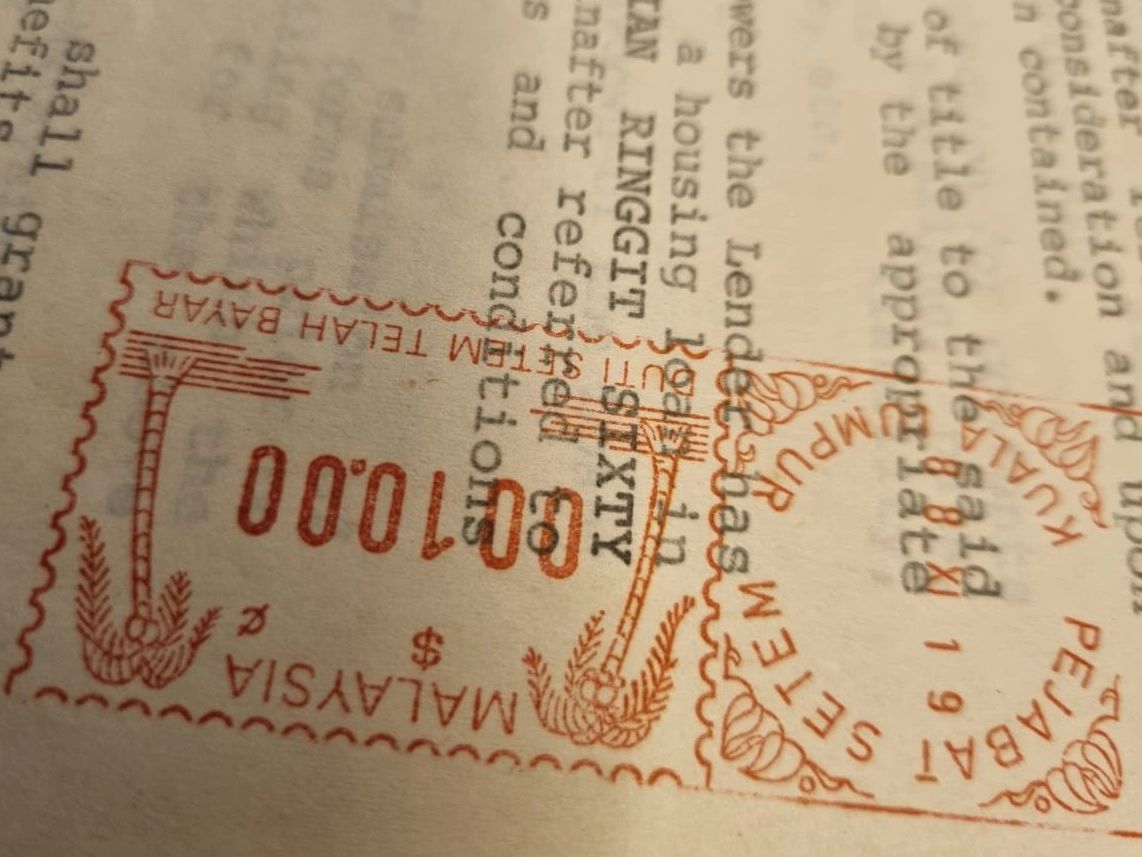

Why Could This Green Chop Cost You Thousands Of Ringgit Asklegal My

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

Stamping A Contract Is An Unstamped Contract Valid

Rental Agreement Stamp Duty Malaysia Speedhome

Seraya Residences Singapore Property Showroom Sell Property Property High Life

Rental Agreement Stamp Duty Malaysia Speedhome

How Much Does It Cost For Stamp Duty For Tenancy Agreement In Malaysia Property Malaysia

Tenancy Agreement Stamp Duty Malaysia Financial Blogger Ideas For Financial Freedom

Ws Genesis E Stamping Services